With the new year 2021, entrepreneurs will gain a new opportunity to obtain a return on investment in automation and robotization. The tax relief project prepared by the Ministry of Finance and the Ministry of Development is an opportunity to improve the efficiency and quality of production of Polish enterprises.

Many companies are struggling with a shortage of labor and the resulting problems with order fulfillment. At the same time, Poland is at the bottom of European countries in terms of the level of robotization and automation, with a rate of 42 robots per 10,000 employees. This is a gap in the pursuit of world leaders such as Singapore (918 robots) or South Korea (855 robots). There is also a considerable distance between us and our neighbors, according to the Polish Economic Institute< /a>, in Germany the robotization rate is 346, and in Slovakia there are 169 robots per 10,000 employees.

Investment in new technologieswill contribute tomodernization of industrial production,increasing efficiency, improving quality and reducing costs. The implementation of robots will relieve employees, increasing the comfort and safety of their work, and will also allow companies to operate faster and more flexibly in a changing and uncertain reality. As a result, it willincrease the competitiveness of Polish enterprisesin the international arena and facilitate export expansion.

|

|

As Deputy Minister of Finance Jan Sarnowski points out "The relief will cover primarilypurchases of new industrial robotsand the software needed for their operation. This is a key step in building a modern, complete ecosystem of tax reliefs in Poland - acting synergistically at every stage of the production process. This will include research and development relief supporting conceptual work on a new product, and prototype relief supporting the transfer of the idea into practice and production. Another one is relief for investing in a robotic application, containing arobot and all the elements thanks to which it can work and, what is equally important, cooperate with people and other machines and IP-Box” .

Entrepreneurs will be able to additionally deduct 50% of the costs incurred for investing in robotization, regardless of the size and type of industry.

Who will be able to benefit from the robotization relief?

The regulations being prepared assume that the relief will be available to large companies as well as enterprises from the small and medium-sized sector. Both PIT and CIT payers will be able to deduct the costs of robotization during the tax year, and when submitting the annual tax return they will make an additional deduction (similarly to the relief for research and development).

What costs will be eligible for robotization relief?

A deduction from the tax base of 50% of eligible costs related to investments in robotization is to apply to:

- purchase or leasing ofnew robots and cobots,

- purchasing software,

- purchase of equipment (e.g. tracks, turntables, controllers, motion sensors, end effectors),

- purchase of occupational health and safety (OSH) equipment,

- training for employees who will operate the new equipment.

Relief for robotization is part of the relief ecosystem together with R&D and IP Box

The above catalog was prepared based on the experience of research and development relief. An amendment has been in force since 2018, increasing the possibilities of support for entrepreneurs by expanding the types of deductible expenses and the amount of the deduction.

According to the Ministry of Finance, more and more companies are taking advantage of the R&D relief. In 2019, over 3,700 taxpayers benefited from the R&D relief, which is an increase of 34 percent compared to the previous year. From 2019, the IP Box relief is also available, allowing entrepreneurs who commercialize intellectual property rights (IP) obtained from their own research and development activities to benefit from a preferential 5% tax rate.

From when and how long will the robotization relief apply?

Currently, final work is underway on the project, which is scheduled to be debated by the Sejm in the fall of this year. The new regulations are to enter into force at the beginning of 2021 and apply for the next five years, i.e. until December 31, 2025. Therefore, it is worth planning new projects and investments today to make the most of the robotization tax relief.

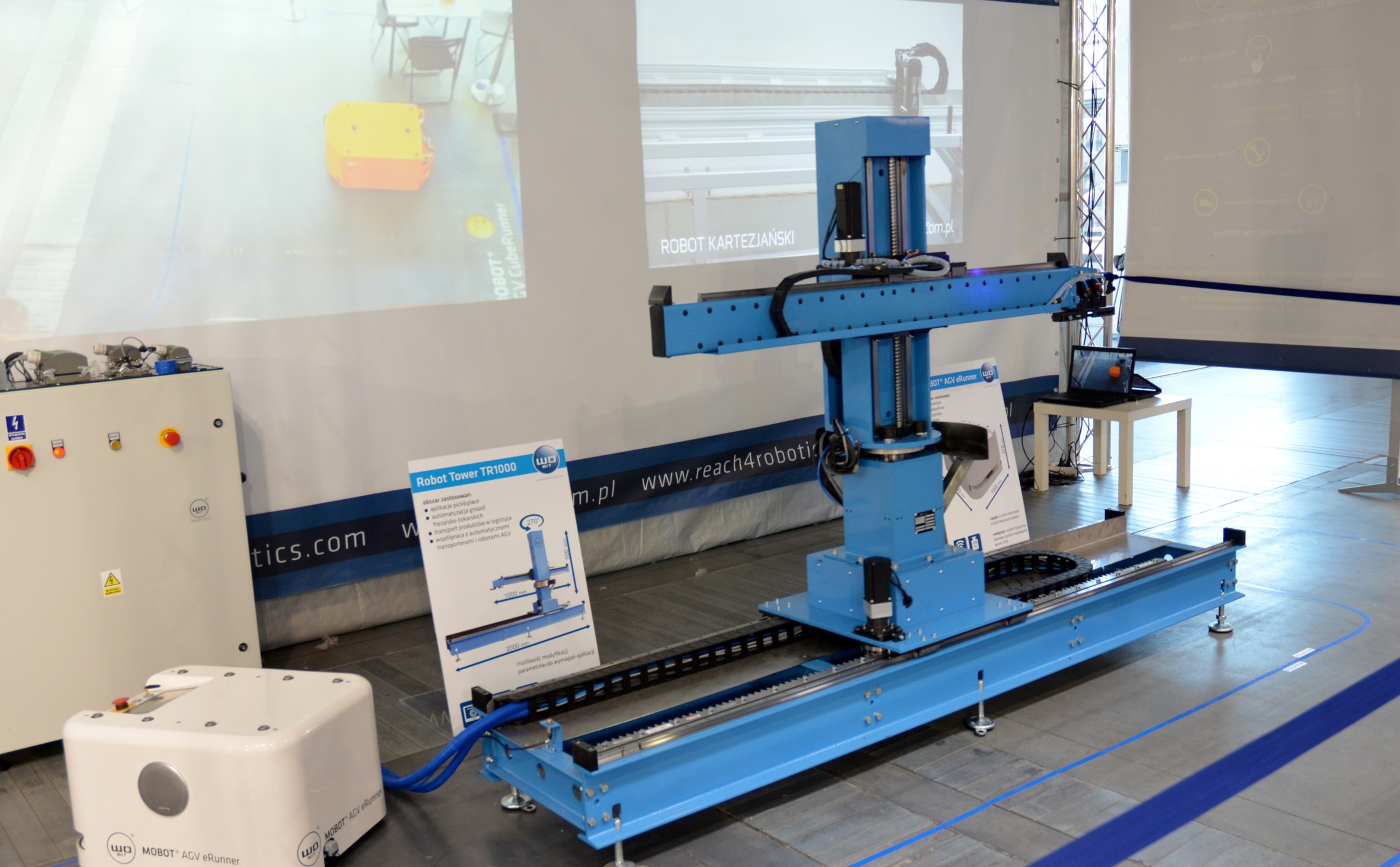

We invite you to talk about robotization and automation of production processes with our experts. Ask whether robotization will work in your company and where to start modernization. Find out which solution will be optimal for your application. Take advantage of the experience and knowledge of the Polish manufacturer of industrial robots, including MOBOT® autonomous mobile robots and cartesian systems.

Make an appointment for a meeting, conversation or presentation of the robot in your company. Call +48 61 2227 410 or use the contact form.

Did you get interested in this article?

If you have any question contact our specialists.